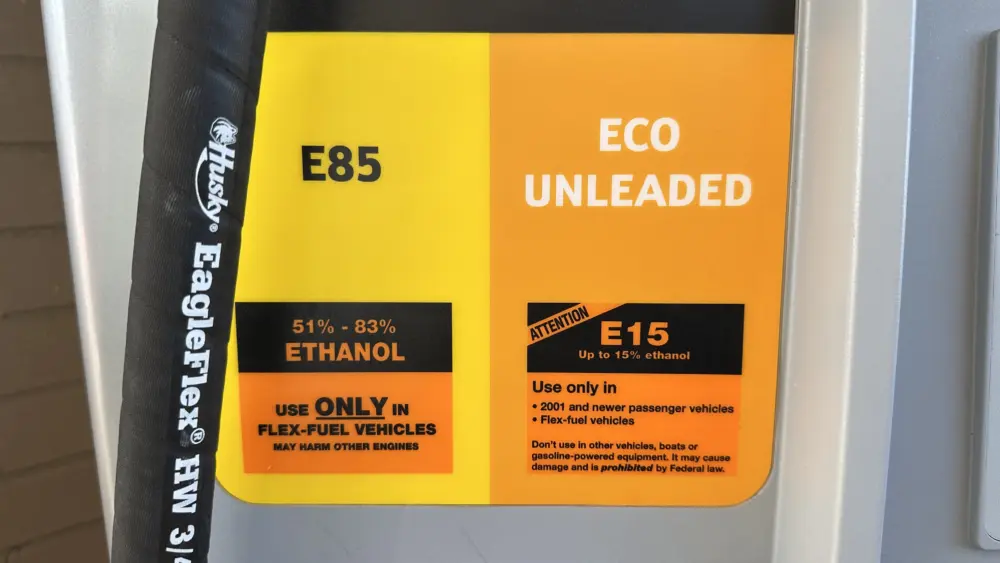

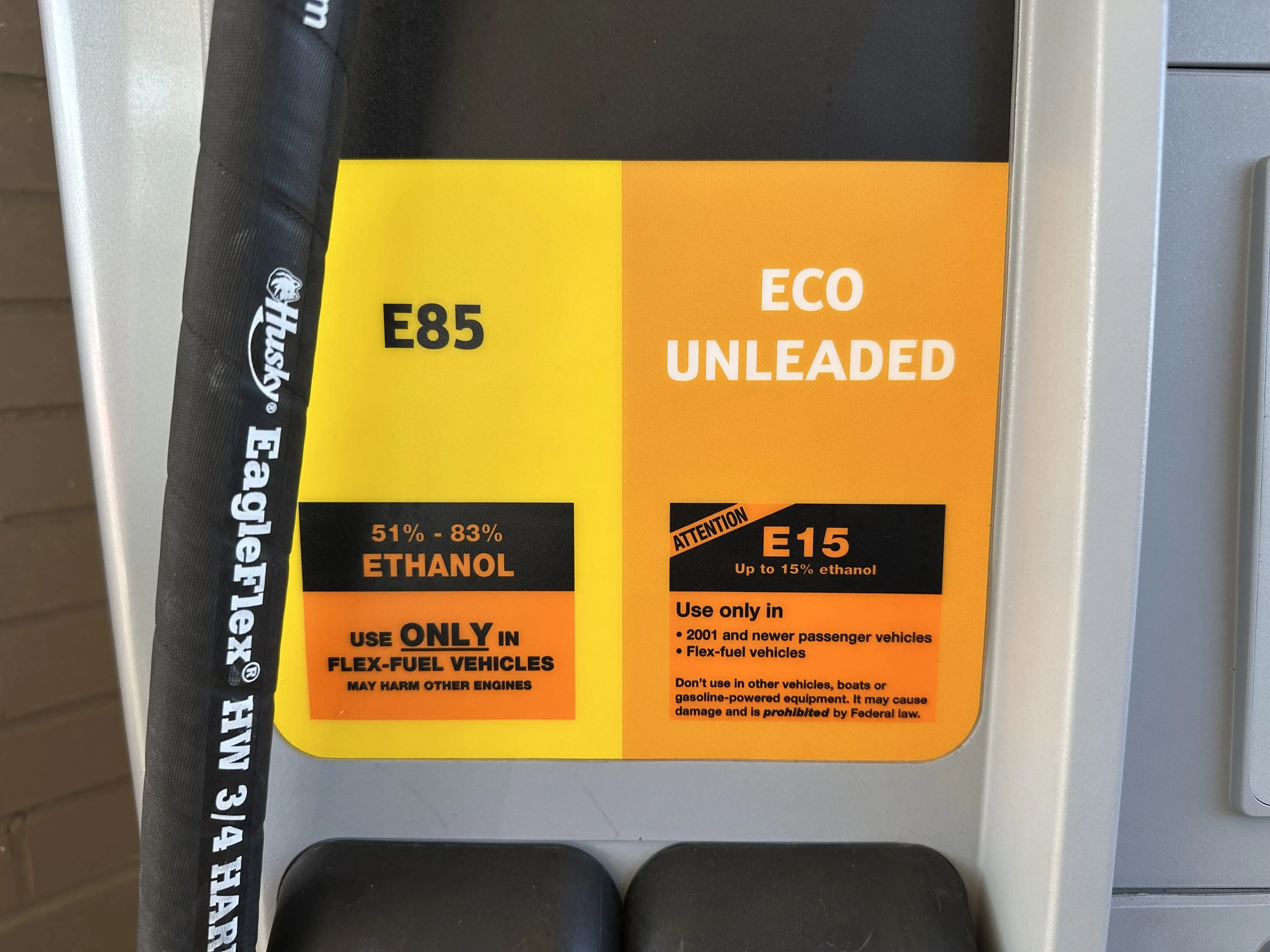

Without immediate passage of nationwide, year-round E15 and access to ultra-low carbon ethanol markets, such as sustainable aviation fuel and marine fuel, Iowa’s corn and ethanol industry will remain on a downward trajectory, according to a new study released by Iowa Corn and the Iowa Renewable Fuels Association.

Iowa’s corn farmers continue to lead the nation in total corn production, and the state has long held the distinction of being the most profitable place in the world to produce ethanol. With Iowa-grown corn yields continuing to rise at a pace roughly 15 percent faster than the national average, access to new and expanded markets is increasingly critical to sustaining the state’s agricultural economy and maintaining long-term profitability for farm families.

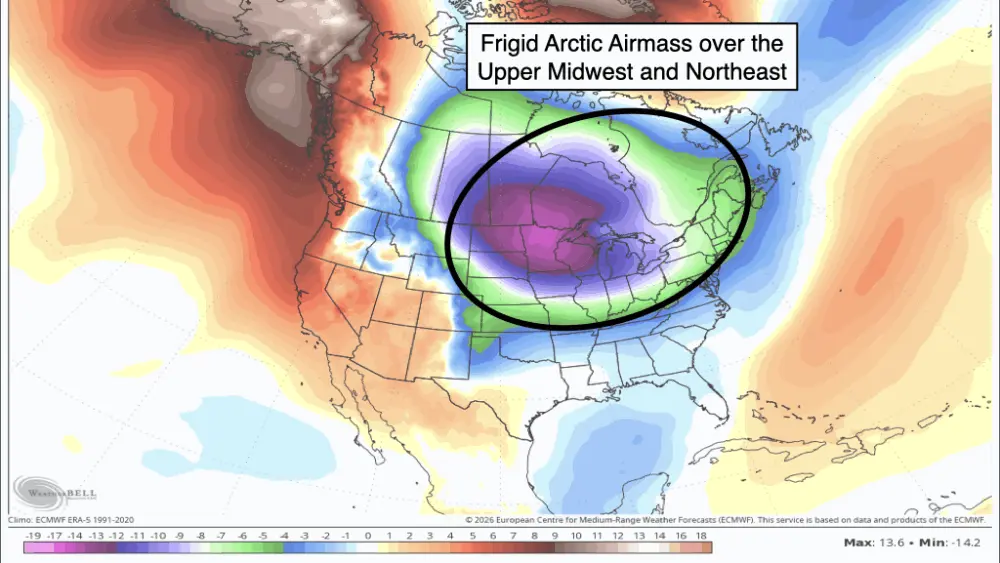

The study is being released at a time when farmers are grappling with a carryout exceeding 2 billion bushels, alongside rising input costs tied to fertilizer, seed, machinery, and other essential farm expenses. According to the study’s findings, corn prices are estimated at $1.52 per bushel under current conditions. Without expanded access to existing markets and the development of new demand channels, the analysis warns that many producers may be forced to scale back operations or exit farming altogether.

“Iowa corn farmers are struggling. Many of us don’t know what the future holds without access to new markets,” said Mark Mueller, president of the Iowa Corn Growers Association, who farms near Waverly, Iowa. “The Corn Impact study is eye opening and provides solutions. Passage of year-round E15 will allow us to shrink the demand gap until we are able to access ultra-low carbon markets, but it isn’t enough to sustain long-term growth. Expanding into ultra-low carbon ethanol markets is essential for long-term viability but requires immediate state policy support to succeed.”

The study emphasizes that long-term profitability will require deploying technology capable of unlocking ultra-low carbon ethanol markets, particularly through carbon capture and sequestration pipelines. This infrastructure is described as the missing link needed to capture emissions at the source, significantly reduce the carbon intensity of ethanol, and generate the verified data required to compete in premium global markets. Four of the top five export destinations for U.S. ethanol—the European Union, the United Kingdom, Canada, and Colombia—already operate under low-carbon fuel policies designed to meet aggressive decarbonization targets.

Without swift action to authorize nationwide E15 to stabilize domestic demand, coupled with investment in critical CCS infrastructure to access global low-carbon markets, the study concludes that Iowa’s economic engine risks stalling. The consequences would extend beyond agriculture, weakening U.S. energy independence, increasing fuel costs for consumers, and allowing international competitors to take the lead in the global transition toward cleaner energy. Iowa, the study notes, already has the resources, technology, and soil needed to help power the world with ethanol, making inaction a costly missed opportunity.

“Without new corn demand, Iowa could be faced with a 1980s farm crisis,” said Mueller.

The study ultimately calls on policymakers to move quickly to authorize nationwide E15 and position Iowa to maintain its role as a global leader in corn production and ethanol innovation.