February 9, 2026

At this hour:

🌽Corn market is down 1-2c, quiet 2 cent range overnight

🌱soybeans are down 3-4c,

🍞wheat is down 2-4c,

🛢️crude oil is up$.30,

💲US Dollar is down 30 points

-Seahawks are Super Bowl Champs.

-Argentina weather has no major changes in the forecast. Slightly drier to be expected with rains to build into late February.

-Brazil should see less Heat / Dryness this week especially in the SW Brazil.

-Brazil harvest slightly behind last year at 13%, 15% LY, 1st crop corn harvest 17% vs 22 LY, 2nd crop corn planting 3% behind last year at 13%

-On Tuesday we will get the February USDA Crop Production report. We will have out pre-report video out on Monday afternoon.

🐂🐻 Looking to start the week off in the Red.

Support/Resistance:

March corn – Support on March corn is at $4.17 3/4 which is the January 13th low. Resistance is at $4.36 1/4 which is the low from January 5th.

July corn – Support comes in at $4.33 1/2 which is the January 16th low. Resistance comes in at $4.50 3/4 which is the low from January 5th.

March soybeans – Support comes in at $10.80 which is the 50-day moving average. Resistance is at $11.15 1/4 which is the high from February 4th.

July soybeans – Support is at $11.02 1/4 which is the 50-day moving average. Resistance is at $11.37 1/4 which is the high from February 4th.

March Kansas City wheat – Support is at $5.26 1/2 which is the 100-day moving average. Resistance comes in at $5.48 1/2 which is the 200-day moving average.

Where do we go from Here:

The corn market gave up the steam on Friday after following soybeans higher on Thursday. Most of the rhetoric will be on the US / China agreement regarding soybean trade and watching the pace of the Brazilian second crop corn. Managed Money bought a net of 3264 contracts week ending Feb 3rd. This makes them Net short 68,786 contracts. New crop corn reached $4.60 last week, and you probably saw that AgMarket.Net put out a couple of trade recommendations. Reach out to us if you did not see the specifics on those recommendations.

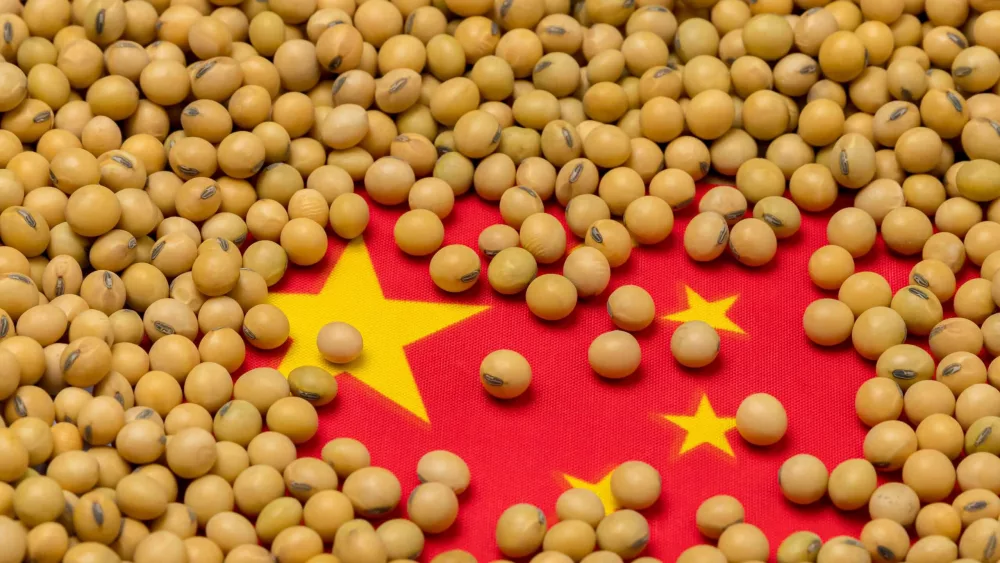

Soybean were on fire last week with the surprise announcement of another 6 million metric tons of soybeans that China could be purchasing in this year or season, or well maybe soon. They did it last time and that’s what the market is going to trade. The funds are net long 28,832 contracts after adding 11,511 last week. Remember that is before the last three days of last week where the market rallied over 87 cents. This is setting up a lot like last fall when we got the first China buying news story. Remember sometimes Geopolitical powers and simply the sentiment of the market can be much stronger than the fundamentals.

The post AgMarket.Net Early Morning Market Analysis 2/09/26 appeared first on AgMarket.Net®.